In the wake of hurricanes Harvey and Irma, two of the worst storms to make landfall in the U.S., the fate of thousands of homeowners is still up in the air. So

Read More

If you’re trying to decide where to spend (or save) it, here are some ideas for how to make the most of your tax return.

Read More

We’re all familiar with fitness fanatics, raving about life changing workouts guaranteed to get you into tip top shape. While there is a new fitness craze in

Read More

No one can predict with any degree of certainty when the next market correction or bear market will occur, or how long it will last. What we do know is that, at

Read More

*This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal

Millennials get a bad rep. Too often does the media say that they’re lazy, unmotivated to work hard, and frivolous with their spending habits. On a weekly basis

Read More

The most important thing about retirement is doing what makes you happy. What would you do with your time if you weren’t working 40 hours every week?

Read More

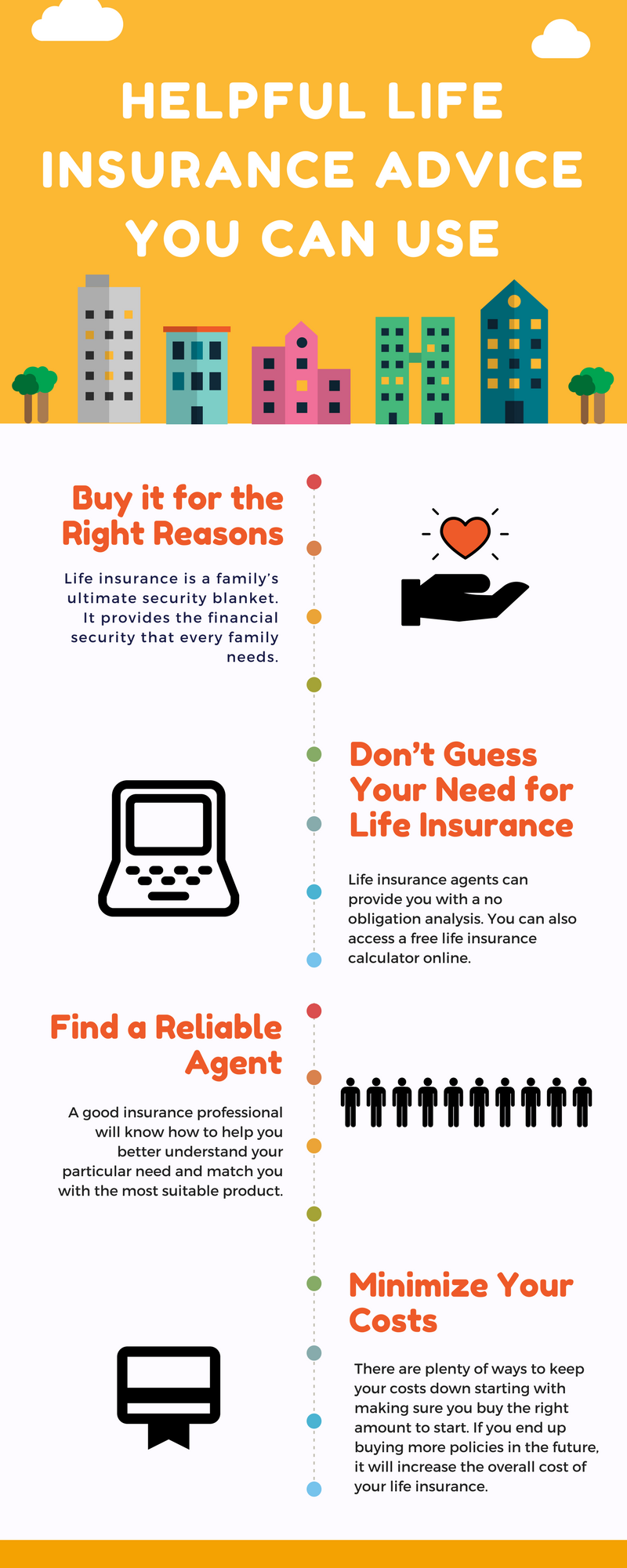

Most financial planners agree that life insurance is essential for protecting families against financial loss, which is why many recommend purchasing the

Read More

So you’ve got your degree, now what? These days, only on television is landing your dream job after graduation a thing that could actually happen.

Read More

It stands to reason that, people who manage to get to the gym on a regular basis are generally healthier people. What you may not know is that they can also be

Read More

Not all investing apps are equal, and depending on your goals it may be better to work with a financial professional instead of an algorithm.

Read More

It’s no surprise that studies show young adults are not into insurance. There are too many other financial challenges to worry about, such as paying off

Read More